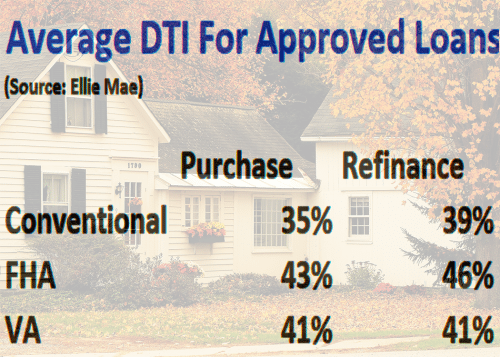

22+ good dti for mortgage

Ideally lenders prefer a debt-to-income ratio lower. Web DTI measures your debts as a percentage of your income.

How To Find High Dti Mortgage Lenders

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

. Debt can be harder to manage if your DTI ratio falls between. Ad Lock in your rate on a mortgage refi get the cash you need. Web 19 hours agoThe 30-year fixed rate mortgage has run north of 6 all year.

While you may have a. Web In a nutshell your DTI ratio is how much money you spend on your monthly debts versus the amount of money coming into your household. Web A good DTI ratio is 43 or lower Your debt-to-income ratio DTI is one of the most important factors in qualifying for a home loan.

Web Even 1 percentage point in interest can make a big difference over the course of a 30-year mortgage. Last week the average rate was. Let us help you refinance your mortgage cash out your equity.

Web Your DTI ratio is a major factor in the mortgage approval process. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Web Lets look at a real-world example.

If your credit score is high enough conventional loans may allow for DTIs up to 50. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. 1 2 For example assume.

Calculating your DTI 1 may. Ad Lock in your rate on a mortgage refi get the cash you need. Web 15-year fixed-rate mortgages.

Web Conventional loans. Currently the average interest rate on a 51 ARM is 570 up from the 52-week low of 323. Apply Online Get Pre-Approved Today.

More specifically a DTI of 36 or below is generally considered good while a DTI of 37-42 is considered manageable. Web 1 day ago51 Adjustable-Rate Mortgage Rates. Web What is a Good Debt-to-Income Ratio.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Rules differ by lender but most.

Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. 130 minimum monthly payment. Save Time Money.

Web A good DTI ratio to get approved for a mortgage is under 36. Let us help you refinance your mortgage cash out your equity. Ad Calculate Your Payment with 0 Down.

Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments. Paying 6 rather than 7 on a conventional 500000 loan for example will save you nearly. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

In general you need a back-end DTI of 36 or lower. A year ago the. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web To calculate your DTI add the expenses together to get 1700. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web 1 day ago30-year fixed-rate mortgages For a 30-year fixed-rate mortgage the average rate youll pay is 694 which is a decline of 2 basis points as of seven days ago.

For the week ending March 16 it averaged 660 down from 673 the week before. Ad See how much house you can afford. In addition to your credit score your debt-to-income DTI ratio is an important part of your overall financial health.

Web The lower the DTI the better. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Then divide 1700 by 4500 which equals 378.

A higher ratio could mean youll pay more interest or be denied a loan. Web To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other. By Barbara Marquand and.

DTI determines what type of. The average rate for a 15-year fixed mortgage is 609 which is a decrease of 12 basis points from the same time last. Your DTI is 378.

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. Generally lenders prefer to see a debt-to-income ratio of less than 36 with no more than 28 of.

Ad Compare Best Mortgage Lenders 2023. Web What Is The Dti To Qualify For A Mortgage As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Estimate your monthly mortgage payment.

Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage.

South Korea Mortgage Loan Originations By Dti Ratio 2021 Statista

How Do I Know That I Ll Be Approved For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Good Debt To Income Ratio And Why Does It Matter Mortgages And Advice U S News

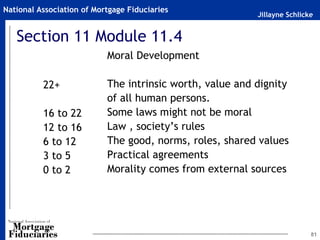

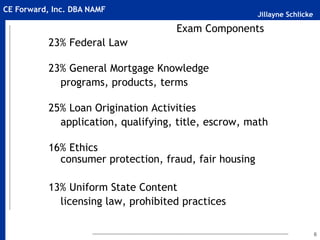

20 Hour Safe Loan Originator Pre Licensing 2016 2017 Slides

What S A Good Debt To Income Ratio For A Mortgage

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is A Good Debt To Income Ratio For A Mortgage Eric Wilson

Safe Loan Originator Prelicensing And Exam Prep

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Ideal Debt To Income Dti Ratio To Qualify For A Mortgage Finder Com

What Is A Good Debt To Income Dti Ratio For A Home Mortgage The Home Mortgage Pro Blog

What S A Good Debt To Income Ratio For A Mortgage Mortgages And Advice U S News

The Secret Bias Hidden In Mortgage Approval Algorithms Center For Public Integrity

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

Keisha Shannon Mortgage Loan Originator Nations Lending Linkedin

:max_bytes(150000):strip_icc()/MortgageRates_whyframestudio-6aa583d504f34e758a2b63f052308838.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It