Depreciation calculation formula in excel

Although each formula has its own information requirement which we will discuss with each formula but the following three are common in all the excel depreciation formula. 1 Scrap ValueAsset Value 1Life Span In the end the template displays the depreciation schedule.

Depreciation In Excel Excel Tutorials Microsoft Excel Tutorial Excel Shortcuts

Depreciation Rate The rate as calculated in FY 2014-15 should be filled Rest of the values shall be calculated automatically Date of format should be ddmmyyyy No field should.

. Choose from many topics skill levels and languages. For example the formula in cell J50 is. The depreciation expense of an asset is deducted from the net income and taxes are paid on income after depreciation.

Notice is not used before ROW COLUMN reference so that the formula could be copied over to calculate Depreciation amount for other years. This formula subtracts the amount of sum-of-years-digits depreciation to be taken at the end of the first year from the original cost of 50000 in cell C7 also brought forward from. To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using.

The template calculates the Rate of Depreciation applying the following formula. If the asset will produce 200 units in its first year period the units of production depreciation value will be the 8000 20000 - 4000 400 200. DDB cost salvage life period factor The following formula calculates the double-declining balance depreciation for the 3 rd year of an asset with an initial cost of.

The depreciation expense is scheduled over the number of years corresponding to the useful life of the respective asset. In this post we shall learn how to calculate different types of depreciation on assets costs in Excel. I understand that the test should be for.

SLN 1000 100 5. Drag the formula for years 2 to 8. Depreciation is calculated using the formula given below.

In the above example the formula calculates depreciation at a fixed rate. I am working on a project for calculating depreciation and having trouble changing my formula for depreciation expense to an IF formula. Excel has the DB function to calculate the depreciation of an asset.

In last post we learnt about how to calculate compounded interest in MS Excel. Rate of Depreciation 1 500050000 15 3690 First Years Depreciation 50000 3690. With row 48 calculating each periods representative depreciation the total depreciation charge in row 50 becomes trivial.

If you have an asset that cost 1000 and has a residual value of 100 after 5 years you can calculate the annual straight line depreciation of the asset as follows. The method of depreciation varies according to an assets actual. Periodic Depreciation Expense Beginning book value x Rate of.

Depreciation Expense Cost Salvage value Useful life 2 Double Declining Balance Depreciation Method. Depreciation Expense Total PPE.

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

Macrs Depreciation In Excel Formulas To Calculate Depreciation Rate Excel Formula Excel Calculator

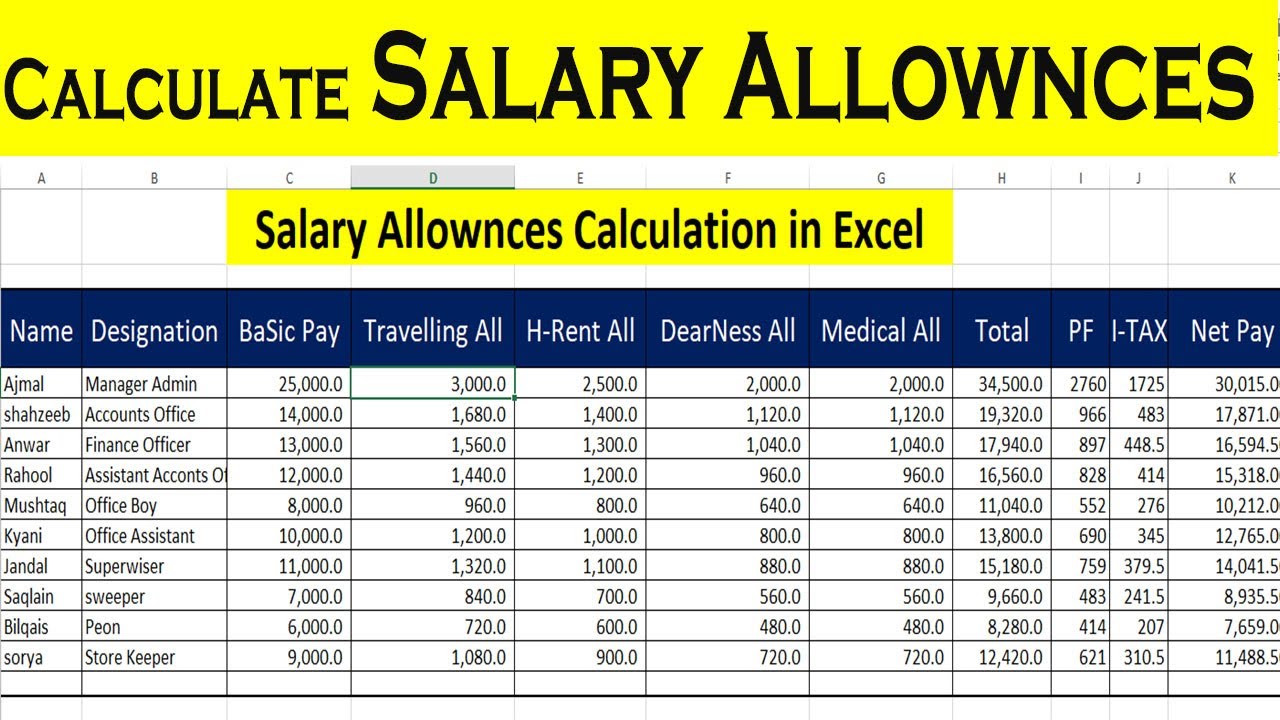

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Learning Centers Tax Deductions Excel

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

Macrs Depreciation Table Excel Excel Templates Basic

How To Calculate Book Value 13 Steps With Pictures Wikihow Economics Lessons Book Value Books

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping Bookkeeping Templates Accounting Basics Learn Accounting

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Schedule Template Depreciation Schedule Irs Depreciation Schedule Excel Template Dep Schedule Template Marketing Plan Template Schedule Templates

The Sum Of The Years Digits Method Of Depreciation Accounting Education Learn Accounting Sum

Download Apartment Maintenance Accounts Excel Template Exceldatapro Excel Templates Excel Accounting

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Computer Generation Excel